News

Feb 12, 2024

Market Trends and developments in Africa

By Charnel Francis, Chief Business Development Officer, Africa Mobility Services

CMMB Member, Africa (Region 1)

As African nations emerge from the aftermath of the COVID-19 pandemic, they grapple with challenges such as a sluggish global economy, pervasive worldwide inflation, high borrowing costs, enduring exchange-rate pressures, cost of living crisis and ongoing political instability. Over the past few years, Africa has encountered substantial challenges in attracting foreign direct investment (FDI), primarily stemming from a sequence of global shocks, initiated by the onset of the COVID-19 pandemic.

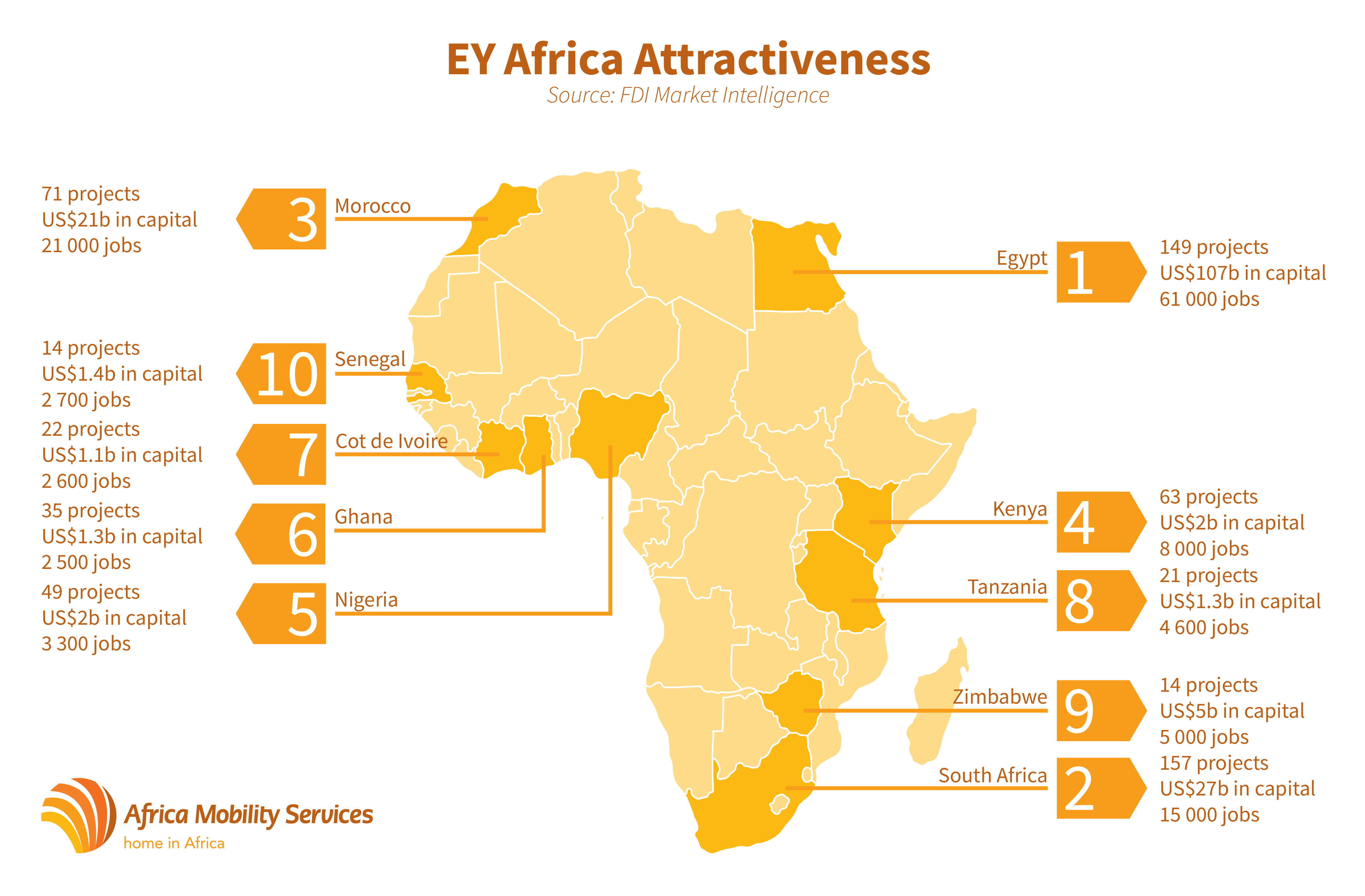

Despite the challenges faced in Africa, the continent does continue to attract foreign direct investments. The following list highlights the top 10 countries in Africa in terms of direct investment projects:

The United States maintains its position as Africa’s leading investor by project numbers, contributing 13% to the continent’s total investment, reaching its highest share since 2016. However, in terms of capital, the U.S. lags behind the United Arab Emirates, France, and India. South Africa, Egypt, and Kenya emerged as the top recipients, with notable projects in telecoms (South Africa), business services (Egypt), and technology (Kenya).

The surge in CleanTech Foreign Direct Investment is propelled by a burgeoning “green revolution” taking root in Africa, with a focus on developing renewable energy infrastructure. However clean energy investments are heavily concentrated in specific nations. South Africa, Egypt, Morocco, and Kenya collectively represent almost 75% of all renewable energy investments since 2010, totaling US $46 billion. Despite this progress, there is a substantial shortfall in clean energy adoption as fossil fuels continue to dominate the majority of Africa’s power generation. While Africa receives Foreign Direct Investment, this influx frequently does not result in the establishment of moving or relocation services

in the region. Many business licenses entail a requirement for a designated percentage of the workforce and management to be hired locally, with only a restricted number of critical skills or visas being allocated.

Under the prevailing policies, it’s evident that Expatiates arriving to work in Africa are opting for short-term contracts and transitioning into furnished accommodations. As a result, this has a direct impact on the volumes of relocations to and from Africa.

Education continues to be a formidable challenge in Africa, as nearly 60% of youth aged 15-17 is not enrolled in school. Unfortunately, the existing policies must undergo a transformation to facilitate the issuance of more visas to expatriates for the successful completion of projects. This adjustment would provide African moving companies with increased opportunities.